Watch These Palantir Price Levels After Stock’s Nasdaq 100 Inclusion

-

Palantir shares are likely to be in the spotlight on Monday after the Nasdaq announced late Friday that the analytics software provider had been added to the Nasdaq 100 Index.

-

The stock has continued to trend sharply higher after breaking out from a cup and handle pattern, though the relative strength index cautions overbought conditions that could lead to near-term price fluctuations.

-

The measuring principle, which calculates the percentage change to the cup and handle’s “cup” and adds it to the pattern’s top trendline value, projects a bullish price target of $140.07.

-

Investors should watch key lower levels on Palantir’s chart at $45 and a zone of support between $33 and $29.

Palantir Technologies (PLTR) shares are likely to be in the spotlight on Monday after the Nasdaq announced late Friday that the analytics software provider, along with MicroStrategy (MSTR), and Axon Enterprise (AXON), had been added to the Nasdaq 100 Index.

The stock’s inclusion into the tech-heavy benchmark comes after it has more than quadrupled from the start of the year as of Friday’s close, boosted by growing demand for the software maker’s customizable artificial intelligence (AI) offerings. The company’s shares became eligible to join the index following a strategic move to the Nasdaq from the New York Stock Exchange (NYSE) last month.

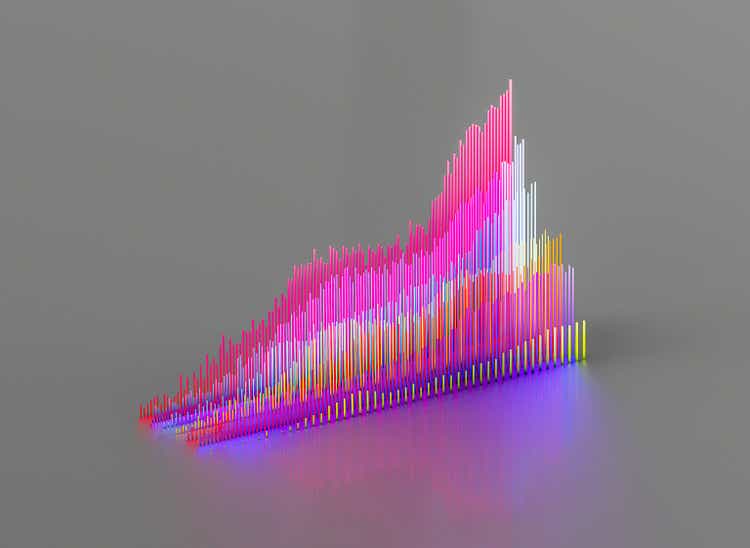

Below, we break down the technicals on Palantir’s weekly chart and identify key price levels that investors may be watching out for.

Since breaking out from a multi-year cup and handle pattern in August, Palantir shares have continued to trend sharply higher. Trading volumes have supported the move higher, indicating buying participation from larger market participants.

The relative strength index (RSI) confirms bullish momentum, though the indicator’s elevated reading above 80 cautions overbought conditions, which could lead to near term-price fluctuations.

Let’s apply technical analysis to project a longer-term bullish price target, while also pointing out key support levels that may attract buying interest during retracements.

To forecast a potential bullish price target, investors can use the measuring principle, a chart-based technique that analyzes the cup and handle pattern to project a future move.

When applying the method to Palantir’s chart, we calculate the percentage change to the cup and handle’s “cup” and add it to the pattern’s top trendline value. For instance, we add a 383% increase to $29, which projects a target of $140.07, around 85% above Palantir’s closing price on Friday.

#Watch #Palantir #Price #Levels #Stocks #Nasdaq #Inclusion