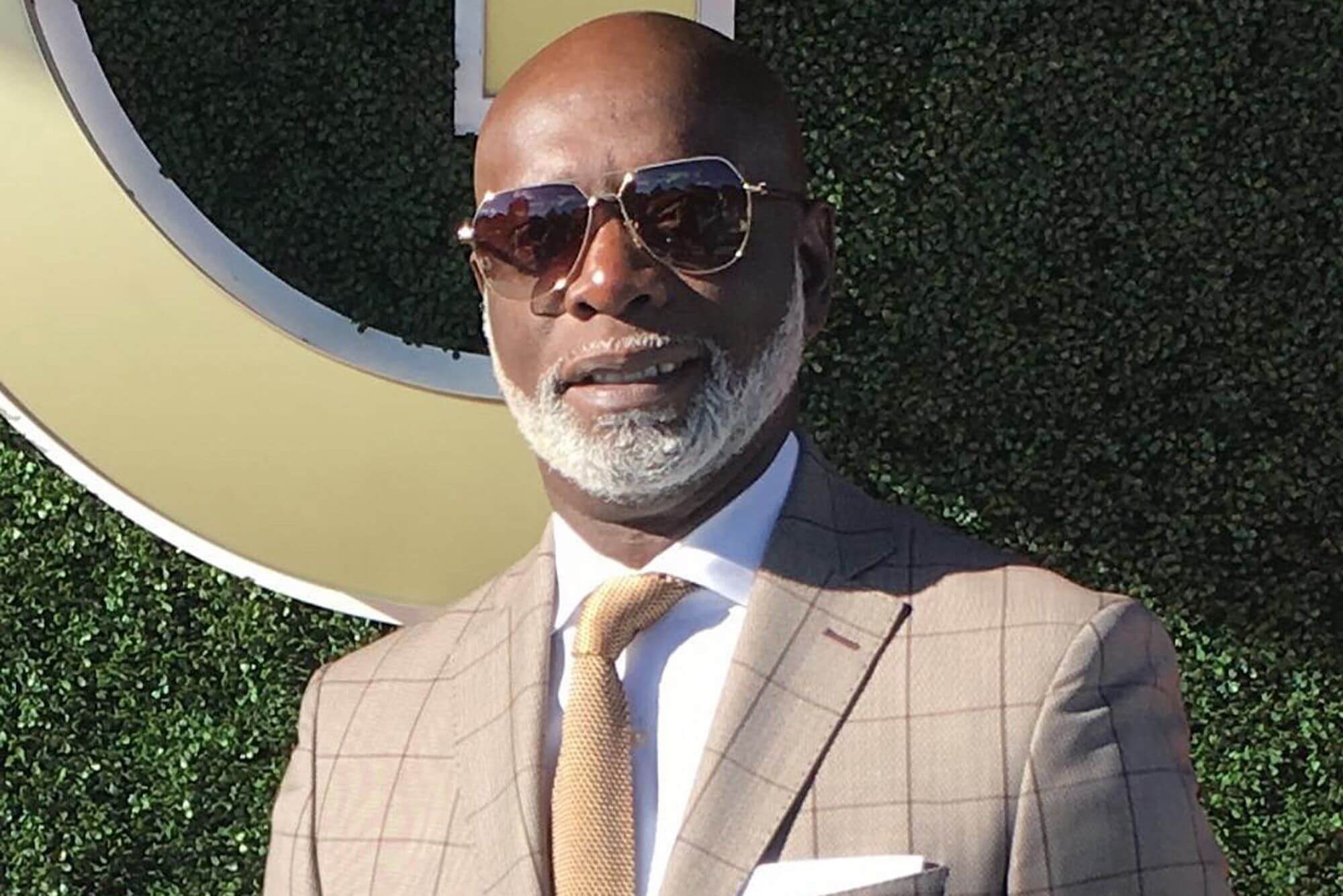

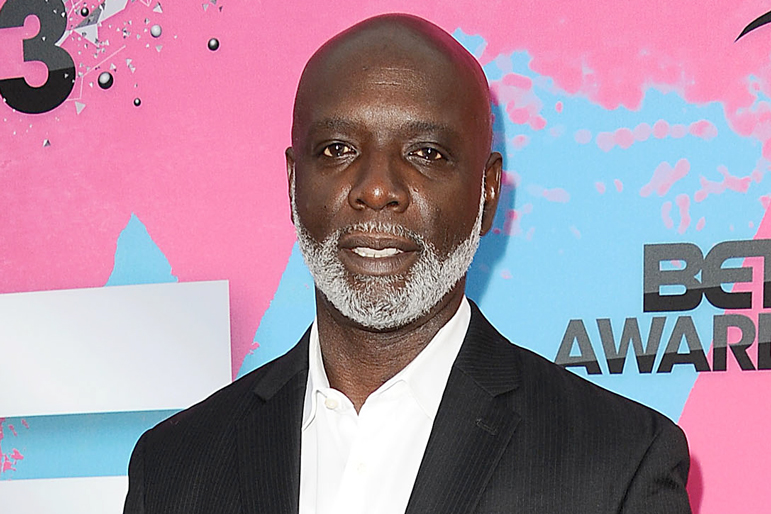

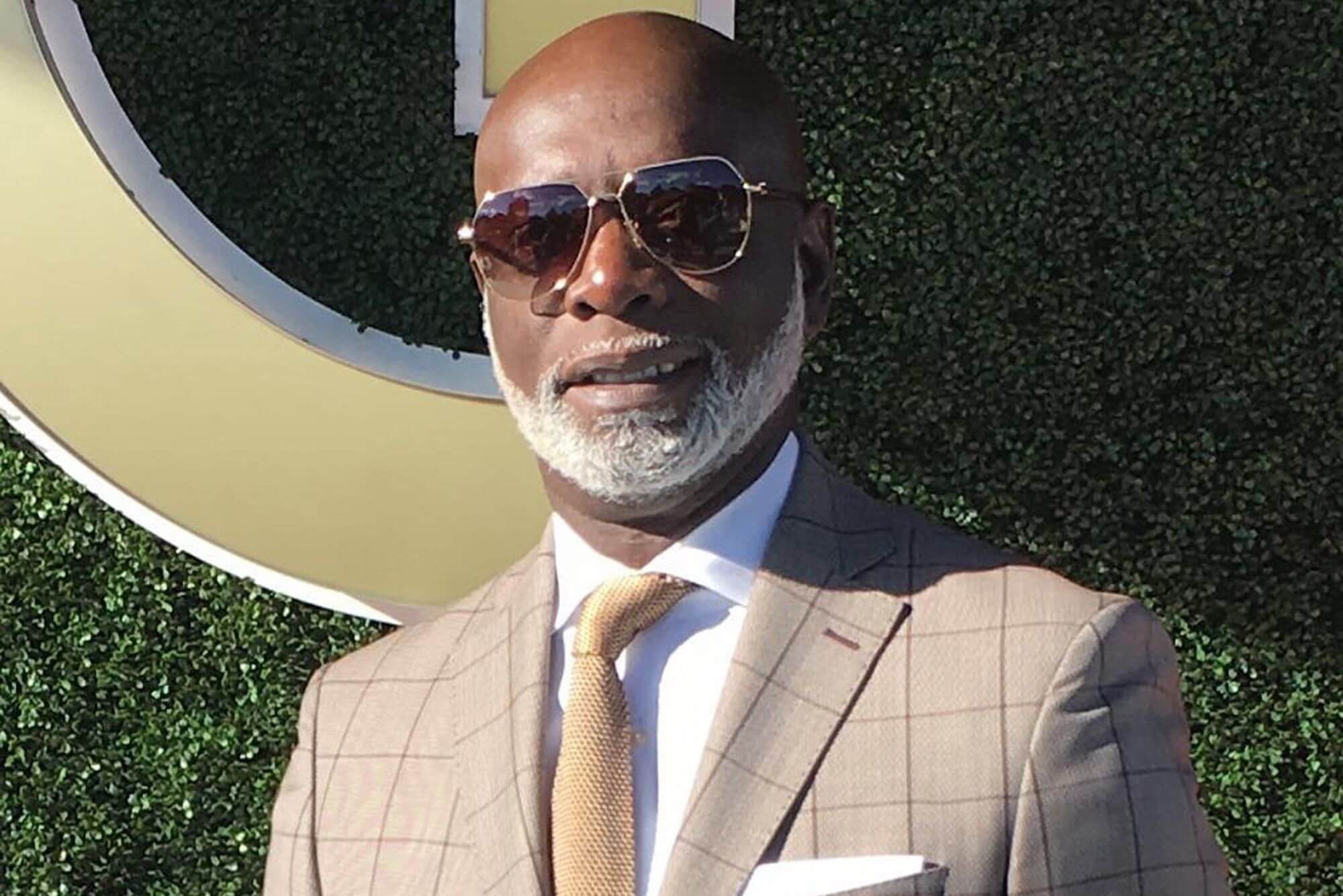

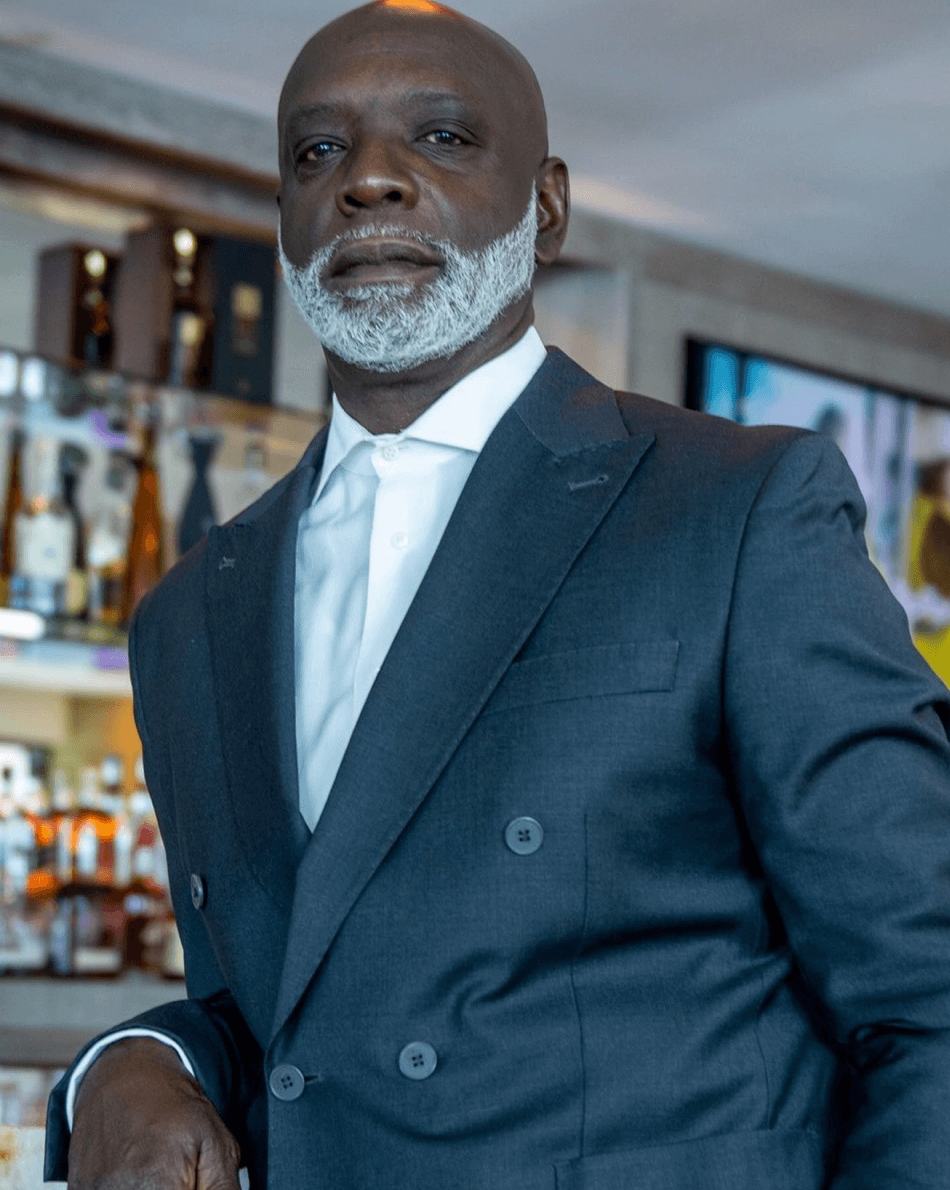

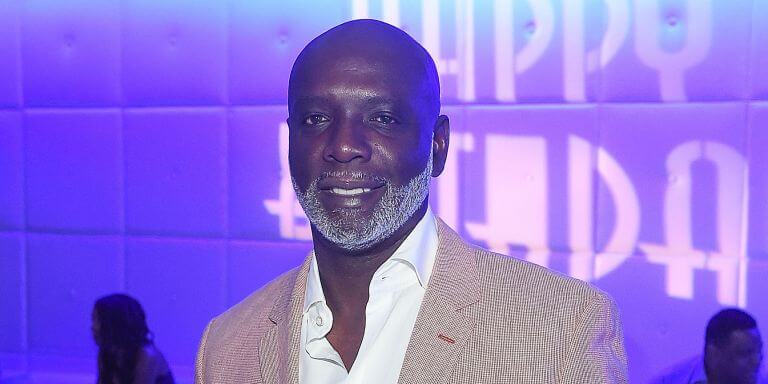

‘RHOA’ Alum Peter Thomas Sentenced To 18 Months In Prison For Tax Evasion!

‘RHOA’ Alum Peter Thomas Sentenced To 18 Months In Prison For Tax Evasion!

Real Housewives of Atlanta alum Peter Thomas has been sentenced to 18 months in federal prison for failing to pay over $2.5 million in employment taxes.

The sentencing took place on Thursday in a U.S. District Court in Charlotte, North Carolina, presided over by Judge Kenneth D. Bell Sr.

Sentencing Details

In addition to the prison term, Judge Bell ordered Peter Thomas, 64, to serve two years of supervised release following his incarceration and to pay restitution for the unpaid taxes. Peter had pleaded guilty in June to one count of failure to pay over trust fund taxes.

Tax Evasion Scheme

Between 2017 and 2023, Peter owned and operated several businesses, including Club One CLT, Sports ONE, Sports ONE CLT, PT Media, Bar One Miami Beach, and Bar One Baltimore. During this period, these establishments failed to pay employment taxes, including more than $1.7 million withheld from employees’ paychecks. Instead of remitting these funds to the Internal Revenue Service (IRS), Peter used the money for personal expenditures.

Prosecution’s Argument

Assistant U.S. Attorney Caryn Finley advocated for a prison sentence of at least two years, emphasizing that Peter’s actions were driven by greed and a blatant disregard for tax laws. Finley stated that Peter used the misappropriated funds to “personally enrich himself and to expand and support his other business ventures,” including spending over $250,000 on luxury items from brands such as Prada, Louis Vuitton, and Givenchy.

She further noted that while individuals are free to spend their money as they choose, they “cannot steal other people’s money — in this case their employees’ payroll taxes—to prop up their otherwise failing business ventures.”

Defense’s Plea

Peter’s attorney, C. Melissa Owen, requested a more lenient sentence of one year and one day, highlighting Peter remorse and his positive standing in the community. Owen described her client as “incredibly remorseful for his failure to pay trust fund taxes,” and noted his reputation as a supportive father, loyal brother, and son. She also mentioned that Thomas has used his social media platform to advise small business owners on the importance of fulfilling IRS obligations.

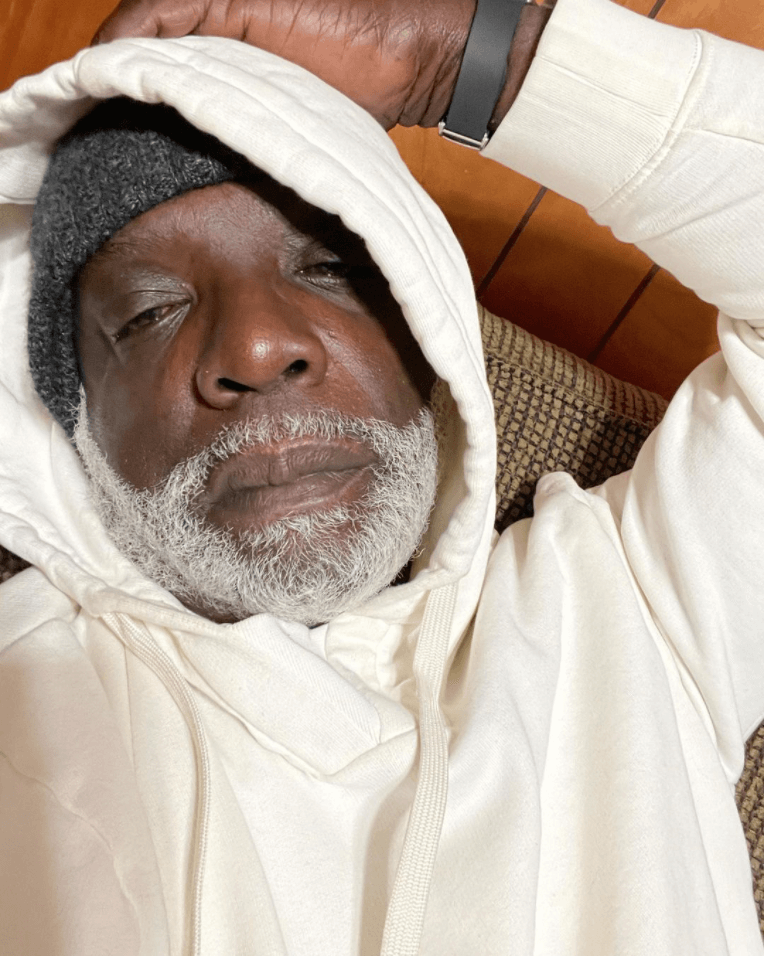

Thomas’s Statement

Prior to sentencing, Peter addressed his situation on Instagram, acknowledging his wrongdoing and expressing readiness to “face the music” after pleading guilty to the tax charges. He reflected on his 50th anniversary of arriving in the U.S., remarking, “I didn’t think I would be celebrating it quite like this.” Peter also offered advice to fellow business owners, stressing the importance of prioritizing payroll taxes over other expenses to avoid legal repercussions.

Background

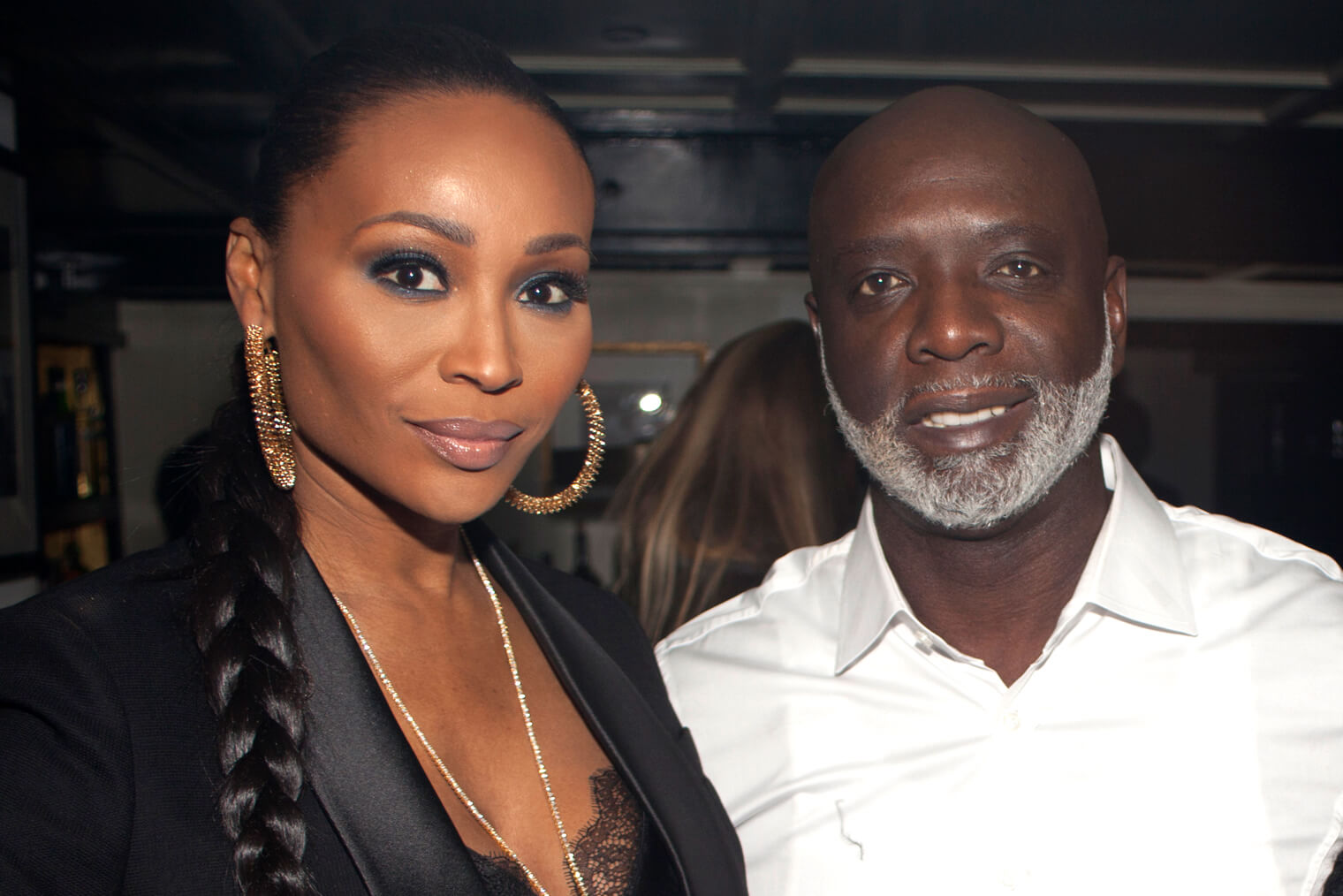

Originally from Kingston, Jamaica, Peter moved to the United States as a child and was raised primarily in Brooklyn, New York. He has managed and owned restaurants and nightclubs for nearly four decades, gaining national recognition through his appearances on “The Real Housewives of Atlanta” alongside his then-wife, Cynthia Bailey.

Legal Implications

Failure to pay over employment taxes is a serious federal offense, as employers are entrusted to withhold taxes from employees’ wages and remit them to the IRS. Misappropriation of these funds not only violates tax laws but also jeopardizes employees’ future Social Security and Medicare benefits. Peter sentencing serves as a cautionary tale to business owners about the severe consequences of neglecting tax obligations.

For more detailed information, refer to the official press release from the U.S. Attorney’s Office for the Western District of North Carolina.

Stay Connected With All About The Tea: Twitter Ι Instagram Ι YouTube Ι Facebook Ι Send Us Tips

Avigail is an Entertainment blogger at All About The Tea, who specializes in The Real Housewives of Atlanta and The Real Housewives of Potomac. Avigail has a background in marketing. She’s a Brooklynite living in the Bahamas, with a passion for travel, writing, reality TV watching, pop culture and spoken word.

#RHOA #Alum #Peter #Thomas #Sentenced #Months #Prison #Tax #Evasion